Invoice and mandate scams can have devastating consequences for small businesses. Your finances can be drained, leaving you unable to pay employees, suppliers, or bills. It can disrupt your operations, harm your business’ credibility, and even lead to closure in severe cases. Since small businesses are more vulnerable to these scams, they must be aware of them and take precautions to avoid falling victim. So, how can invoice and mandate scams affect small businesses?

Invoice and mandate scams can blackmail small businesses into transferring money to the wrong accounts, thinking they’re paying legitimate bills or employees. These scams can drain a business’s finances, causing financial stress, disrupting operations, and potentially leading to business closure if the losses are significant.

Keep reading to find out more about what you need to know about invoice and mandate scams, how to spot one, and how they affect small businesses.

How Do Invoice and Mandate Scams Affect Small Businesses?

Small businesses are particularly vulnerable to invoice and mandate scams, which can cause a great deal of damage. In order to protect yourself from these scams, knowing how they can impact your business is vital. Take a read below of the different ways that invoice and mandate scams can affect small businesses.

| Invoice Scams | Mandate Scams |

| Financial Losses: Small businesses can suffer significant financial losses if scammers trick them into paying fake or inflated invoices. | Customer Trust Erosion: If customer accounts are affected due to mandate scams, the trust between the business and its clients can erode |

| Reputation Damage: Falling victim to invoice scams can harm a business’s reputation, as customers and partners may lose trust in the company’s financial management capabilities. | Regulatory Issues: Businesses might face regulatory issues if customer data is compromised during mandate scams, leading to legal penalties and fines for failing to protect sensitive information. |

| Potential Legal Consequences: In some cases, small businesses might face legal consequences if they unwittingly participate in fraudulent activities, even if they were victims themselves. | Operational Disturbance: Dealing with the fallout of mandate scams can cause operational disturbances, diverting management’s attention away from business growth and planning. |

Looking to protect your business from invoice and mandate scams? At NEBRC, we understand how crucial it is to educate small businesses about cybersecurity challenges in today’s technology-driven world. Technology provides businesses with various advantages such as managing communication, storing files, and accessing financial resources. Our Free Core Membership is created to offer you useful materials and continuous assistance, enhancing your ability to withstand cyber security threats. To sign up, check out our website.

What You Need To Know About Invoice and Mandate Scams

In the first half of 2024, over £570 million was stolen through various payment frauds, including invoice and mandate scams highlighting the ongoing risk to businesses and individuals. These scams involve fraudsters impersonating suppliers and falsely claiming changes in payment bank account details to deceive businesses. Scammers will pretend to be familiar suppliers to avoid suspicion, targeting small businesses as they are vulnerable. If you succumb to an invoice or mandate scam, once you pay, it’s tough to trace and recover your money. To learn more about email fraud, check out our blog here.

How To Protect Your Small Business From Invoice and Mandate Scams

✓ Verify Payment Details: Always double-check new payment info with a trusted contact before sending money out.

✓ Use Known Contacts: Confirm changes by calling a number you already have for the supplier. Scammers often use fake contact info on invoices.

✓ Test Payments: If unsure, make a small test payment to ensure it reaches the right place.

Don’t become a victim! Stay vigilant against these scams.

How To Spot an Invoice or Mandate Scam

Identifying an invoice or mandate scam is extremely important when trying to protect your business. Listed below are a few things to look out for when spotting an invoice or mandate scam.

- An existing service provider sends you new bank details that are different from the ones you currently have.

- You will not receive duplicate or frequent invoices from a genuine service provider. Consequently, if you receive repeat or excessive invoices, it may be a scam.

- The use of pressure tactics is a common sign of invoice or mandate scams. Pressuring you to pay immediately to avoid penalties or legal consequences, is a warning sign. Scammers use fear to rush your decision.

Are you concerned about invoice or mandate scams affecting your small business? By joining our free core membership service, you will receive a welcome pack, a monthly newsletter, a free risk check, and bespoke recommendations that will help you mitigate threats.

How Invoice and Mandate Scams Are A Huge Threat To Small Businesses

Fraudsters took over £1.2 billion just in 2022. That works out to more than £2,300 every minute. With 78% of cases conducted online, this is the most common method of case research. Many businesses are unaware of the risks despite these statistics. That’s why NEBRC are here to help you become aware of cybersecurity risks and keep your business protected online.

Example of an Invoice Scam

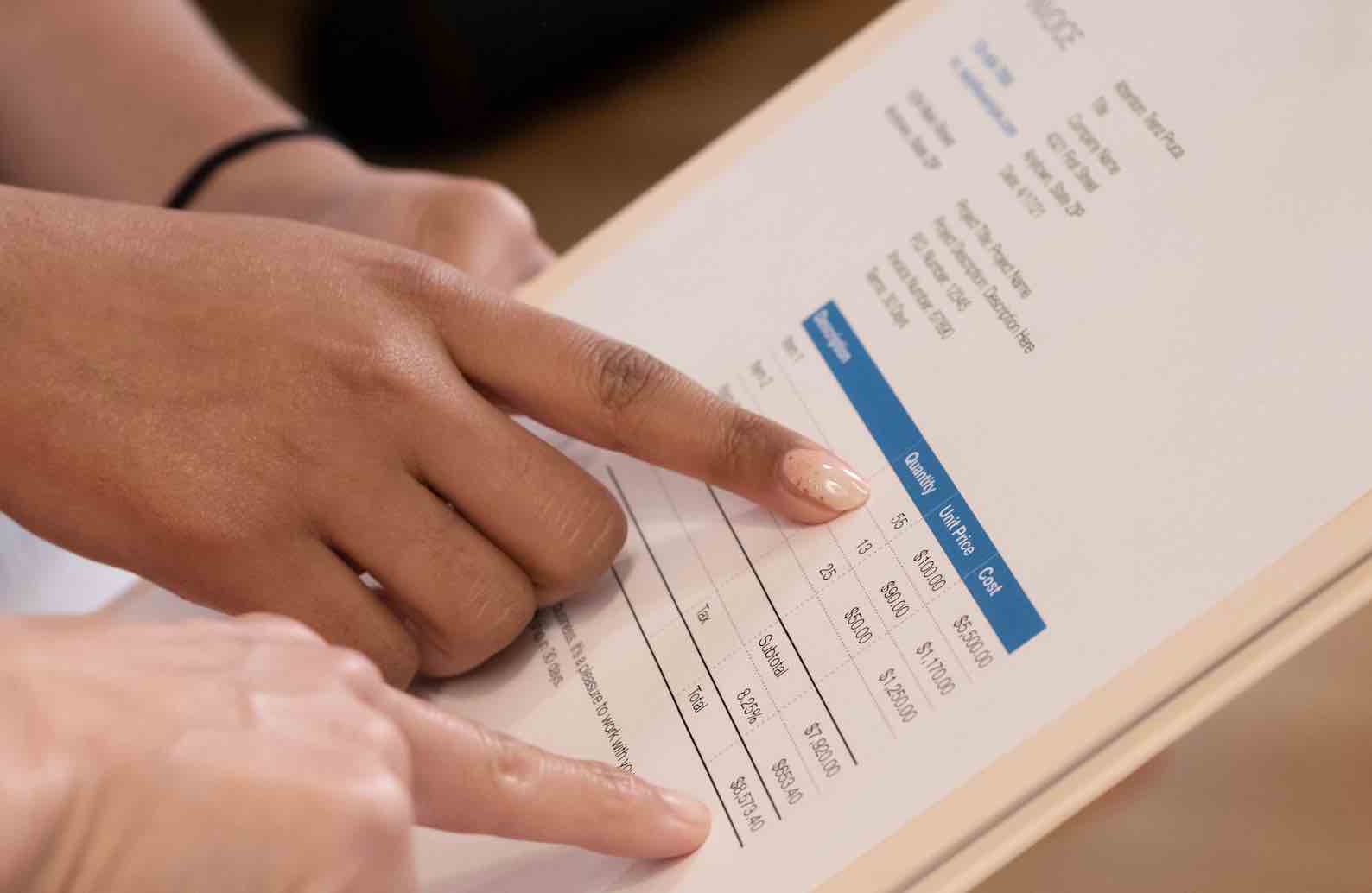

Below, we have created a fictitious example of an invoice scam email to illustrate how scammers operate. This email shows the use of pressure tactics and an excessive payment amount, both of which are frequently employed in such scams. These tactics are particularly effective against small businesses, which are often viewed as vulnerable targets. The sections highlighted in bold indicate common signs of an invoice scam.

“Dear [Your Company Name],

We hope this email finds you well. We are writing to inform you about an outstanding invoice that requires your immediate attention. Failure to settle this invoice within the next 24 hours will result in severe consequences, including legal action and suspension of services.

Invoice Details:

Invoice Number: 987654

Invoice Amount: £10,000.00

Due Date: [Current Date + 1 day]

It is imperative that you process this payment urgently to avoid the penalties associated with late payment. We understand that your time is valuable, but we urge you to prioritise this matter and settle the outstanding amount immediately.

To expedite the payment process, we kindly request that you make the payment via wire transfer to the provided bank account details. Once the payment has been made, please reply to this email with the transaction reference number for our records.

Please note that further delays in payment will result in additional fees and legal actions. We trust you will treat this matter with the utmost urgency to prevent any disruptions to your business operations.

Thank you for your prompt attention to this matter.

Sincerely,

John”

To protect your business against invoice scams, click here for further information.

How Can NEBRC Support You With Invoice and Mandate Scams?

The NEBRC offers all businesses within the region free core membership to gain access to a wealth of handy cyber security resources and stay up to date with the latest news regarding the digital landscape. To sign-up click HERE. For further guidance on how to protect your small business from invoice and mandate scams, contact [email protected]

About NEBRC

The NEBRC is a non-profit organisation that seeks to educate, inform, and support businesses across the UK on how to stay safe online through strong cyber security practices.

FAQs

What Are Invoice and Mandate Scams?

Essentially, invoice and mandate scams are when criminals pose as builders, solicitors, tradesmen or people from trusted organisations to get your bank account details. Resulting in you being tricked into sending money to an account which is controlled by them.

At NEBRC, we help small businesses learn how to protect their business online. Find out more about cybersecurity for your business here.

What are the 3 Most Common Invoice Scams?

Scammers are consistently finding more ways to scam individuals and businesses. However, here are the 3 most common invoice scams.

- Illegitimate Vendors: Scammers pose as vendors, sending seemingly genuine invoices to businesses.

- Fake Invoices: Fraudsters send invoices that appear authentic but contain slight changes, like altered addresses or bank details. Businesses, thinking they’re valid, approve these changes.

Intercepting Mailed Checks: Despite digital advancements, many companies still mail checks, making them susceptible to interception. Fraudsters edit check details digitally and deposit them into their accounts.